hard money lenders in Atlanta Georgia Specializing in Rehab Loans

hard money lenders in Atlanta Georgia Specializing in Rehab Loans

Blog Article

Exploring the Conveniences and Dangers Connected With a Hard Money Finance

Navigating the intricate globe of genuine estate financing, financiers commonly run into the choice of a Hard Money Financing. The key lies in understanding these facets, to make an educated choice on whether a Hard Money Loan matches one's economic technique and risk resistance.

Comprehending the Essentials of a Hard Money Financing

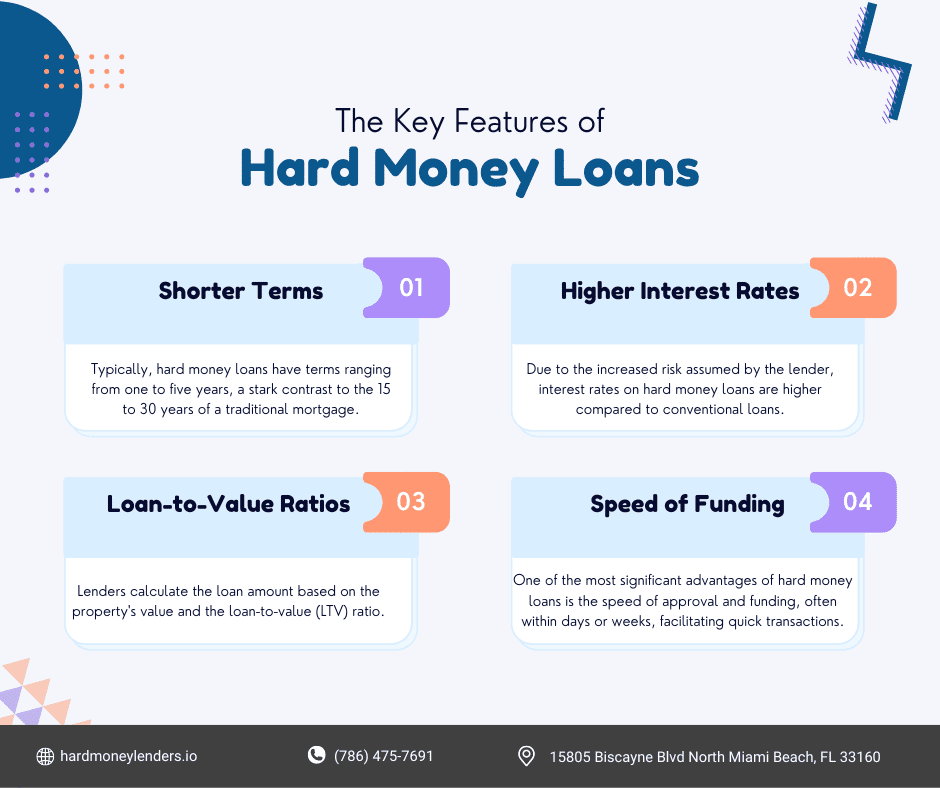

Exactly what is a Hard Money Financing? This sort of financing is typically made use of in property deals and is granted by exclusive financiers or firms. Unlike standard bank finances, tough Money loans are based mainly on the worth of the building being bought, instead of the customer's credit report. They are often short-term, normally lasting one to five years, and feature higher passion prices. These financings are commonly used for investment objectives, such as house flipping or development tasks, instead of individual, domestic use. The authorization procedure is quicker, typically within days, making them eye-catching to financiers requiring prompt funding. The expedited procedure and property-based method also bring one-of-a-kind dangers and factors to consider.

Trick Benefits of Opting for Hard Money Loans

Possible Dangers and Drawbacks of Tough Money Fundings

Despite the attractive advantages, there are some significant dangers and drawbacks connected with difficult Money finances. These loans typically include high rates of interest, sometimes double that of conventional financings. This can lead to monetary pressure otherwise taken care of effectively. Additionally, difficult Money car loans generally have shorter repayment durations, generally around one year, which can be challenging for customers to fulfill. In addition, these fundings are commonly protected by the debtor's residential property. If the borrower is incapable to repay the Funding, they risk losing their home to foreclosure. Finally, difficult Money lenders are much less regulated than typical lending institutions, which may expose consumers to underhanded financing techniques. While difficult Money fundings can give quick financing, they likewise lug considerable threats.

Case Situations: When to Take Into Consideration a Hard Money Loan

Comparing Tough Money Finances With Various Other Financing Options

Exactly how do difficult Money car loans compare to various other financing options? When compared with standard fundings, hard Money finances provide a quicker approval and financing procedure due to fewer laws and needs. Nonetheless, they commonly come with higher rate of interest and charges. On the other hand, bank fundings use reduced rates of interest but have strict eligibility criteria and a slower approval time. Exclusive loans, on the other hand, deal versatility in terms however may lack the structure and safety and security of hard Money loans. Finally, crowdfunding and peer-to-peer loaning platforms provide an unique check over here choice, with affordable prices and simplicity of access, but may not be ideal for bigger financing demands. The choice of funding depends on the debtor's particular needs and conditions.

Verdict

To conclude, hard Money car loans supply a practical service for real estate capitalists needing swift and adaptable financing, particularly those with credit history difficulties. The high rate of interest rates and much shorter settlement durations necessitate careful consideration of prospective dangers, such as repossession. It's essential that website link borrowers completely examine their economic approach and threat resistance before choosing this type of Funding, and compare it with various other funding choices.

Unlike traditional bank fundings, difficult Money fundings are based mostly on the value of the residential property being bought, rather than the customer's credit report score. These car loans typically come with high rate of interest rates, sometimes dual that of typical financings. In scenarios where a customer wants to avoid an extensive Finance procedure, the much more straightforward difficult Money Loan application can supply an extra practical alternative.

When contrasted with standard car loans, here difficult Money loans supply a quicker approval and financing procedure due to fewer regulations and needs - hard money lenders in atlanta georgia. Exclusive fundings, on the other hand, deal flexibility in terms but may do not have the structure and security of tough Money financings

Report this page